2017 Business performance

Group

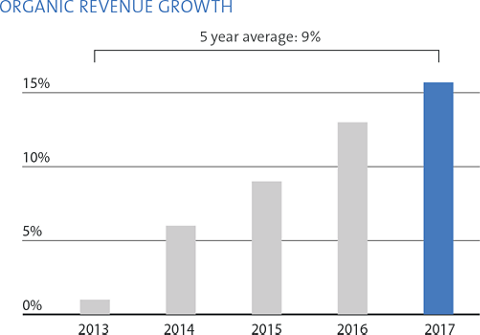

STRONGEST GROWTH SINCE 2007

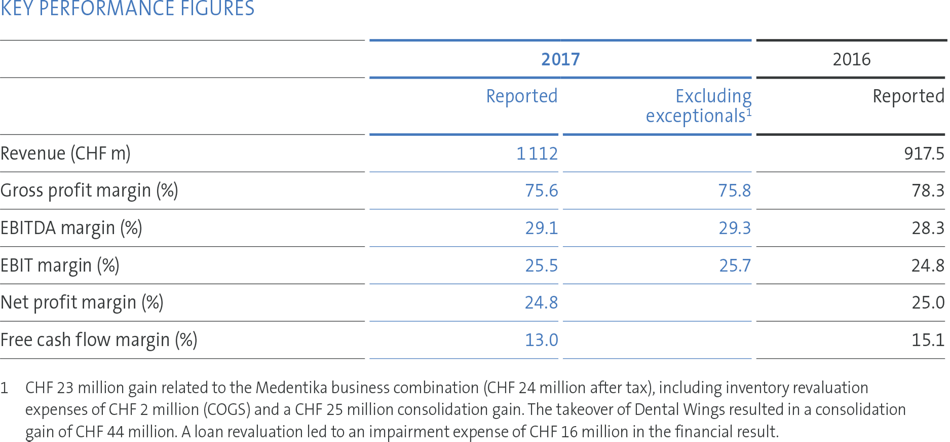

In 2017, the Group reported its strongest growth in ten years, as revenue climbed 21% in Swiss francs to CHF 1112 million. Fuelled by double-digit increases across all businesses, organic growth rose 16%, driven by North America and Asia/Pacific. Acquisitions and business combinations contributed CHF 32 million to revenue.

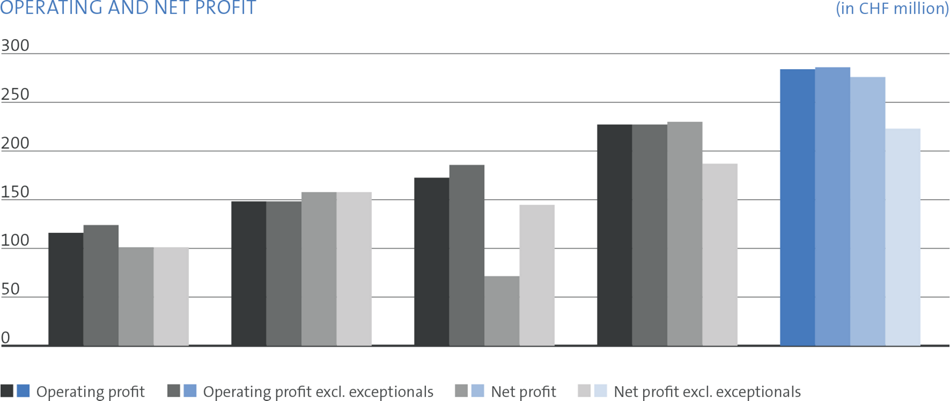

We achieved further improvements in profitability despite significant investments in new segments, geographic expansion, R&D, and production capacity. Underlying EBITDA and EBIT (operating profit) both rose 26%, with the respective margins reaching 29% and 26%. Net profit increased 20% to CHF 276 million, bringing the corresponding margin to 25% and earnings per share to CHF 17.61.

All of our businesses achieved double-digit growth. Two thirds of the growth was generated by the implant business, where Straumann’s BLT range as well as Neodent’s Cone Morse and Acqua implants were the key drivers. Straumann’s Roxolid and SLActive kept momentum and Titanium SLA enabled us to compete successfully in the lower premium segment.

In the non-premium business, Neodent, Medentika, Anthogyr and Zinedent all grew strongly and constitute the fastest growing international implant franchise. Spain, the UK, the US, Brazil and distributor markets were the main drivers. The combined package of complete premium and non-premium solutions has been a key to the success of our Dental Service Organization business, which grew strongly in Europe and won important tenders in the fast-growing corporate dentistry segment.

Our biomaterials continued to grow strongly. Demand was most notable for bone substitutes and membranes – especially in Europe, where the we offer a comprehensive portfolio of guided bone regeneration products.

Our restorative business achieved double-digit growth, driven by demand for implant-borne prosthetics (both standard and CADCAM). Straumann’s cost-efficient, versatile Variobase range was also a major growth contributor. CADCAM screw-retained bars and bridges, ProArch edentulous solutions and the Novaloc fixation system for removable dentures all contributed to growth. Revenues from intraoral scanners and milling equipment accelerated as the year progressed, reflecting our efforts to offer complete end-to-end solutions.

OPERATIONS AND FINANCES

The business combinations of Medentika and Dental Wings led to the following non-cash-relevant effects in 2017:

- On 1 January, we consolidated Medentika. Our 51% stake was previously reported as ‘share of results of associates’, but now contributes to the financial statements at all levels. This business combination led to several one-time effects, which include inventory revaluation expenses of CHF 2 million under ‘costs of goods sold’ and a one-time gain of CHF 25 million below the EBIT line. In connection with this transaction, we further recognized a financial liability of CHF 55 million in the balance sheet to reflect the present value of the put option granted to the founding shareholders.

- In October 2017, we increased our stake in Dental Wings from 55% to 100% and consolidated the business. This led to a consolidation gain of CHF 44 million below the EBIT line.

DOUBLE-DIGIT VOLUME EXPANSION LIFTS GROSS PROFIT

Strong volume growth in premium and value implant solutions lifted reported gross profit by 17% to CHF 841 million. Excluding the exceptional inventory-adjustment charge, underlying gross profit was CHF 842 million and the respective margin reached 76%. This is 270 basis points lower than in the prior year period, reflecting the strong demand for digital equipment, the Medentika integration costs, a higher share of third-party products, the integration of acquired businesses, and ramp-up costs in the expanded facilities.

To cater for strong volume growth and to meet future demand, we invested significantly in production capabilities and capacity expansion in Brazil, the US and Switzerland, resulting in higher production costs.

OPERATING PROFIT (EBIT) MARGIN EXCEEDS 25%

Distribution costs, which comprise sales-force salaries and commissions, as well as logistics expenses rose by CHF 39 million to CHF 250 million as we incorporated the aforementioned businesses, invested further in our direct distribution network in underpenetrated markets, and expanded our non-premium franchise internationally. This figure includes amortization expenses of CHF 10 million mainly for customer-related intangible assets of acquired companies.

Administrative expenses increased from CHF 283 million in 2016 to CHF 311 million in 2017, which includes overheads, R&D and marketing costs for the newly-added businesses. Relative to sales, administrative expenses decreased 290 base points to 28%, which was the key driver of profit margin improvement.

Earnings before interest, tax, depreciation and amortization (EBITDA), and exceptionals increased 25% to CHF 326 million, lifting the respective margin 170 base points to 29%.

After depreciation and amortization charges of CHF 40 million, our underlying operating profit amounted to CHF 286 million (CHF 284 million reported) compared with CHF 227 million in 2016. The underlying EBIT increased 90 base points to reach 26%.

NET PROFIT INCREASES 20%

Excluding exceptionals, the net financial result remained stable at a negative CHF 3 million, largely reflecting coupon payments for the outstanding CHF 200-million corporate bond. We recognized cumulative consolidation gains of CHF 69 million, mainly because the fair value of the investment in Medentika and Dental Wings exceeded the respective carrying amount. This exceptional effect is both cash and tax-neutral and is shown in a separate line in the income statement under ‘Gain on consolidation of Medentika and Dental Wings’.

The share of results from associate partners1 was a negative CHF 10 million compared with a negative CHF 2 million in 2016. The decrease mainly reflects this year’s business combination of Medentika.

Income tax expenses amounted to CHF 48 million in contrast to the exceptional tax income of CHF 7 million in 2016. The sale of treasury shares in September in the amount of CHF 260 million resulted in a one-time tax expense of CHF 8 million. Going forward, the tax rate is expected to be approximately 15%.

The combination of these effects meant that net profit increased 20% to CHF 276 million, with the corresponding margin amounting to 25%. Basic earnings per share increased by nearly CHF 3 to CHF 17.61. Return on equity (ROE) amounted to 32%, and the company is (net) debt-free.

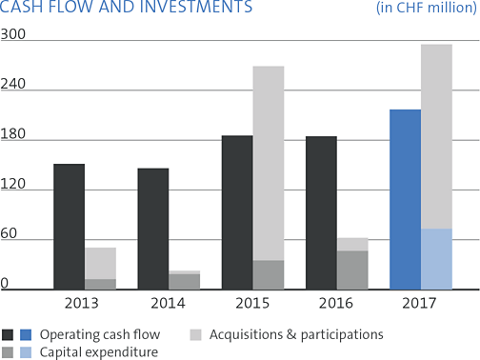

FREE CASH FLOW CLIMBS TO CHF 145 MILLION

Cash flow from operations increased 18% to CHF 217 million, reflecting a strong cash conversion rate of 79%2. Cash generation was constrained by higher inventory levels due to our newly-created subsidiaries, extension of the product portfolio and the product range. The dynamic topline growth in emerging and distributor markets led to an increase in accounts receivable. Days of sales outstanding increased by one to 56. We invested heavily in capacity expansion at various production sites, increasing CAPEX by CHF 27 million to CHF 73 million. The combination of these effects resulted in a free cash flow of CHF 145 million and a respective margin of 13%.

Due to the expansion of our business volume, production capacity, distribution network and acquisition activities, the balance sheet total increased 54% to CHF 1.7 billion by year-end.

FURTHER DIVIDEND INCREASE PROPOSED

Based on the results in 2017 and the outlook for 2018 and beyond, the Board proposes a further dividend increase to CHF 4.75 per share, payable on 12 April 2018. Going forward, the Board’s intention is to increase the dividend per share continuously, subject to further good performance.

OUTLOOK 2018

(BARRING UNFORESEEN CIRCUMSTANCES)

We expect the global dental market to grow at about 4% and are confident that we can continue to outperform and expand our share by achieving organic revenue growth in the low double-digit percentage range. Assuming fairly stable currency exchange rates, the expected organic revenue growth and operational leverage should lead to further improvements in the EBITDA margin, in spite of further investments in Sales & Marketing, Research & Development, and Logistics. With the continued high level of investments in production capacity, as well as the amortization of acquisition-related intangibles, we expect our EBIT margin to remain stable.

SUMMARY OF MAIN INVESTMENTS

INVESTMENTS IN THE NON-PREMIUM SEGMENT

One of the Group’s strategic priorities is to penetrate the fast-growing non-premium segment. Having acquired a 51% stake in Medentika (the German provider of prosthetics for leading implant systems) in 2013, we signed a new shareholder agreement with the founding shareholders to obtain control over the company as of 1 January 2017. This did not involve additional investment as our stake remained unchanged.

INVESTMENTS TO STRENGTHEN EXISTING PARTNERSHIPS

In 2017, we invested CHF 9 million to increase our stake in Rodo Medical Inc. from 12 to 30%. Rodo is a privately-held US company that develops and produces innovative retention devices for dental implant restorations. We also obtained broad exclusive distribution rights and a call option to increase our stake to 51% in 2021.

INVESTMENTS IN PRODUCTION

To meet the strong increase in demand for our products, we invested approximately CHF 43 million in our production plants in Switzerland, the US and Brazil. The latter included additional production space and a new distribution center.

INVESTMENTS IN FORMING THE DIGITAL BUSINESS

To accelerate the development of digital platforms and equipment we increased our stake in Dental Wings Inc. from 55% to full ownership. We entered the field of orthodontics by acquiring 100% of ClearCorrect and 38% of Geniova and we purchased a 35% stake in Rapid Shape GmbH, a leader in 3D-printing technologies, as well as 100% of Loop Digital Solutions, a software developer in patient referral management. Collectively, these investments totalled approximately CHF 215 million.

OTHER INVESTMENTS

The International Team for Implantology is Straumann’s longstanding academic partner and shares our goal of developing optimal treatment solutions to the benefit of patients. In 2017, we supported the ITI with total investments of approximately CHF 11 million (2016: CHF 11 million). Investments in people (training and development) are covered in the Employees section of this report. Information on investments in distribution, including selling activities as well as research, development, intangible and tangible assets and our investment in organizations like the ITI are presented in our financial report.

FOOTNOTES/REFERENCES:

1 Associate companies in 2017 comprise: maxon dental, Geniova, Rodo Medical, Createch, Anthogyr, Rapid Shape, T-Plus, Valoc, V2R, Abutment Direct, and Zinedent. The equity method of accounting is applied for these companies, in which Straumann holds a noncontrolling stake. The associate result is shown net-of-tax and after amortization of intangibles.

2 Relationship between operating cash flow and net profit..