Markets

Position bolstered, addressable

market expanded

THE GLOBAL DENTAL SUPPLY AND EQUIPMENT MARKET

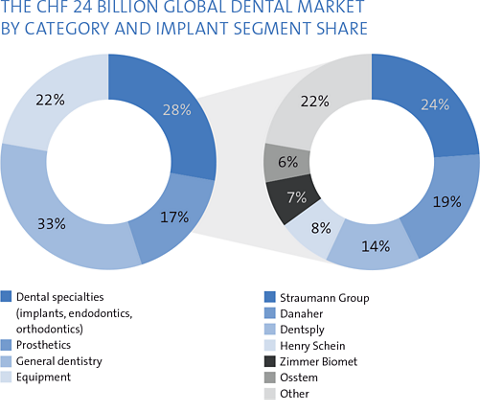

The global dental supply and equipment market is an attractive subset of the global medical device sector with annual sales of approximately CHF 24 billion1. Increasing prosperity and awareness of oral health, as well as the aging population, and innovation are the main drivers of market growth, which typically exceeds that of gross domestic product.

IMPLANTS

Implant dentistry accounts for nearly 15% of the overall dentistry market and is part of the dental specialties segment. We estimate that the market for implant dentistry was worth CHF 3.7 billion2 in 2017, including implant fixtures, abutments and related instruments. The Straumann Group leads this market and holds an estimated share of 24%, which it has expanded in recent years through continual outperformance. Independent market research firms including DRG and iData project that growth in this segment will outpace the dental market as a whole. The implant segment thus offers an attractive return-on-investment, particularly for large and innovative companies that can benefit from economies of scale.

Internal intelligence and external research are essential for estimating market size because few players disclose sales information. Using this approach, we estimate that the global market picked up slightly and grew 4% in 2017. Volume growth outpaced that of revenues, reflecting strong growth in emerging markets, where average prices are lower, the increased share of non-premium products, and modest price deflation in general.

The implant market itself can be divided into two segments: premium and non-premium. Premium companies are distinguished by pre-clinical research and development activities, pre- and postmarket clinical documentation, product innovation and breadth, as well as added-valued services. The Straumann Group leads both the premium segment and the implant market as a whole. Nonpremium manufacturers hold substantial combined market shares in several large markets, where dentist fees are comparatively low, e.g. Brazil, Russia, Israel, and South Korea. Even though the growth differential between the two segments is diminishing, the non-premium market continued

to grew faster in 2017. By value, three quarters of the market are controlled by the leading six companies. The remainder is distributed among more than 400 manufacturers, most of whom are non-premium and compete mainly on price, with limited research, training and education services.

Our Straumann premium brand offers a wide range of implants at various prices, depending on the material and surface technology, while our Neodent, Medentika, Equinox, Anthogyr, and Zinedent brands enable us to compete in the non-premium segment, offering customers implant systems at multiple price options in different regions as well as attractively priced abutments for third-party systems.

HIGH POTENTIAL IN THE PREMIUM TAPERED-IMPLANT SEGMENT

Dental implants are distinguished by their design: tapered implants offer high primary stability, while parallel-walled implants are versatile and have been documented for 30 years. More than two thirds of the implants sold in 2017 were tapered. Over the years, Straumann and the ITI have been strong proponents of parallel-walled implants and Straumann controls roughly half of this segment. Contrastingly, our Neodent brand has offered tapered implants for many years. In 2015, Straumann entered the premium tapered segment with BLT and, based on volumes, had gained a share in the low teens by the end of 2017, which is a third of our share of the parallel-walled segment. Our goal is to gain further share of the tapered segment in the coming years, for example through targeted marketing initiatives, further product launches and geographical rollouts.

MARKET PENENTRATION STILL LOW

The principal factors driving growth in the tooth replacement market are:

- Demographics – more elderly people need tooth replacement as the population ages

- Affordability – the middle class is growing in developing countries

- Adoption – the number of trained dentists who are confident placing implants is rising

- Awareness – patients are better informed about the negative effects of poor oral health

- Esthetics – the trend in people choosing cosmetic surgery and dental implants is growing.

The number of Americans ages 65 and older is projected to more than double from 46 million today to over 98 million by 2060, and the 65-and-older age group’s share of the total population will rise to nearly 24 percent from 15 percent.3 The American College of Prosthodontists estimates that the number of partially edentulous patients will continue to increase.4 90% of edentulous people use simple, unanchored dentures. Some accept their limitations; others cannot afford implant solutions. In 2015, the World Health Organization estimated that more than 60% fall in this category. Many would prefer to upgrade to implant-supported fixed or removable overdentures. To serve this market, we offer a range of premium and non-premium solutions including fixed and removable options, and we have been working on simpler, cost-efficient protocols that are needed to serve a larger pool of patients.

Cost is an obstacle. Private insurance schemes are either financially unattractive or apply strict entry criteria. Even in cases where insurance companies cover dental implant procedures, the amount reimbursed is rarely sufficient to cover the full cost of treatment, leading to considerable costs for patients, which can discourage them from choosing the procedures. In countries where the difference in price is small and/or where there is reimbursement, there is a clear preference for implant solutions.

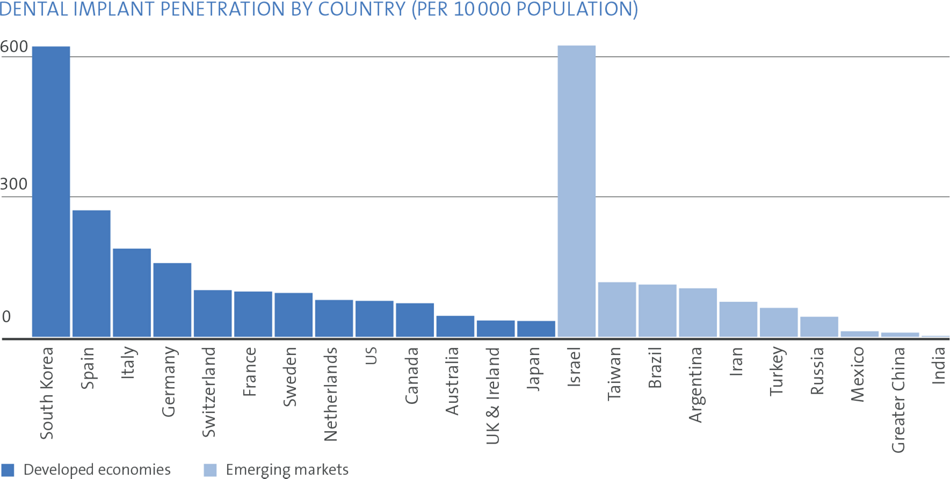

With very few exceptions, tooth replacement is an out-of-pocket expense. In South Korea, reimbursement was gradually introduced for senior citizens in 2014. This, together with the fact that more than 70% of the dentists in the country place implants, explains the high penetration rate. By contrast, large economies like China and India remain heavily underpenetrated due to a lack of qualified dental professionals.

The pool of potential patients seems inexhaustible. In the developed world, more than 600 million people are affected by tooth loss, but only a fraction seek treatment. In the world’s largest market, the US, more than 150 million people are missing at least one tooth, yet just over a million are treated each year (corresponding to 2.5 million implants). This is low in absolute terms and in comparison with other countries. Our analysis shows that only one in five medically eligible US residents who seek treatment for tooth loss actually receive implants5. In Germany, the penetration level is approximately 25%, while in Switzerland, it is close to 40%6.

As the chart shows, the number of implants placed per 10 000 population in the US is only half that of the largest European market, which illustrates the considerable growth potential. Penetration in other highly populated countries like the UK, India, China and Japan is also clearly below average, offering strong upside potential in the coming years.

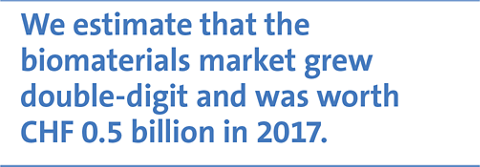

BIOMATERIALS

The Straumann Group is also active in the regenerative dentistry market, which is interrelated with implant procedures and offers considerable cross-selling potential. We estimate that the global market for biomaterials, which includes bone-augmentation materials, membranes, fleeces, sponges and soft-tissue regenerative products, was worth more than CHF 0.5 billion in 2017.

PROSTHETICS

Digitalization makes it possible to design and mill prosthetic elements by computer-aided design and manufacturing (CADCAM), saving time and increasing accuracy. The CADCAM-prosthetics market segment is thought to be worth more than CHF 3.7 billion and comprises crowns, inlays, onlays, bars, and bridges. Tooth-borne restorations, crowns and small bridges make up the lion’s share. While CADCAM production is growing strongly, most crowns and bridges are still composed of porcelain-fused-to-metal or press ceramics made by a time-consuming manual process. Market research7 indicates that general dentists usually obtain CADCAM crowns and bridges from local labs, and most use models or impressions to order the restorations.

CADCAM makes it possible to use strong, translucent glass-ceramic materials like Straumann n!ce and zirconia, which look natural and are fracture-resistant. Internal and independent surveys have shown that patients are increasingly willing to invest in treatments that not only restore function, but which also improve appearance.

CADCAM EQUIPMENT

We estimate the global market for CADCAM dental equipment, which comprises optical scanners as well as milling equipment, to be worth CHF 1 billion.

CADCAM systems can be classified as:

- Chairside systems, where scanning, design and milling are all performed in the dental practice, using compact milling machines,

- Full in-lab systems, with scanning, design, and manufacture on medium-sized milling machines, and

- Central milling, in which lab scanners connect to an external milling center that uses sophisticated, heavy milling machines

We entered the chairside and lab-milling segments last year, complementing our well established centralized milling option.

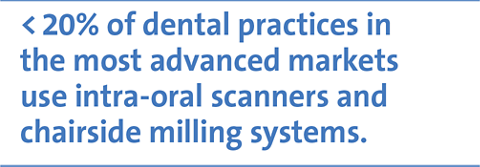

Penetration of the chairside segment is modest. Less than 20% of dental practices in the most advanced markets (e.g. the US, Germany and Switzerland) use intra-oral scanners and few have invested in a chairside milling system8, underscoring the market’s potential opportunity.

In contrast to dental practices, labs have invested in CADCAM technology. In developed countries, more than half of the dental labs have an in-lab scanner and most of them also have invested in milling technology9. The vast majority of larger labs in advanced countries like the Netherlands, Germany and the US work digitally. Medium-sized and large labs/dental practices are more advanced and tend to prefer complete CADCAM systems over stand-alone scanners because they have financial resources and higher volumes of restoration production. Technology is advancing fast and thanks to the multiple applications (restorative, orthodontic, prevention) intra-oral scanners are becoming the gateway to the digital dental universe. More and more dental schools are including CADCAM in their curricula, which should drive penetration.

We are convinced that the future lies in open software architecture that offers connectivity to hardware supplied by various manufacturers. While data transfer between terminals, labs and practices is becoming easier, compatibility is a frequent issue and there is a growing requirement for validation. This is why we offer an integrated CADCAM portfolio, including leading chairside and in-lab scanning and milling technology, 3D in-lab printing and central milling, supported by leading-edge software and validated workflows covering the tooth-replacement spectrum.

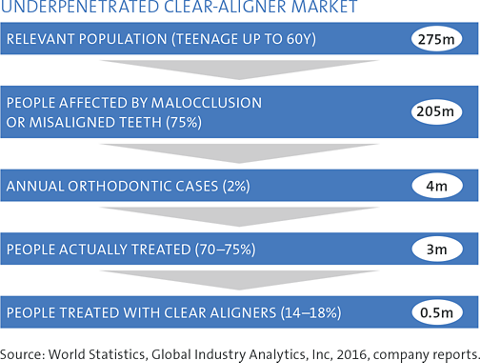

CLEAR ALIGNERS

Growing awareness, broader availability (e.g. through general dentists) and the increased importance of dental esthetics are key growth drivers for the clear-aligner market, which is estimated to be worth over CHF 1.5 billion and growing at a double-digit-percentage rate.

Research indicates that 75% of the population in North America10 have malocclusion/misaligned teeth. Considering that there are 275 million residents in the US and Canada between the ages of 12 and 60, the patient pool amounts to 4 million patients annually. Of the three million orthodontic cases treated in North America in 2017, most received conventional wires & brackets, while approximately one sixth received clear-aligner solutions. It is estimated that 50% of all patients with misaligned teeth could theoretically be treated with current clear-aligner solutions. This underscores the future market potential.11 The penetration rate is lower in other countries, where the clear-aligner market is still emerging.

In 2017, we entered this attractive field by fully acquiring ClearCorrect, a well-established provider of full clear-aligner tooth-correction solutions. We also acquired 38% of Geniova, a small entrepreneurial company in Spain, which has pioneered an innovative hybrid approach combining the advantages of clear aligners with the benefits of conventional braces and brackets.

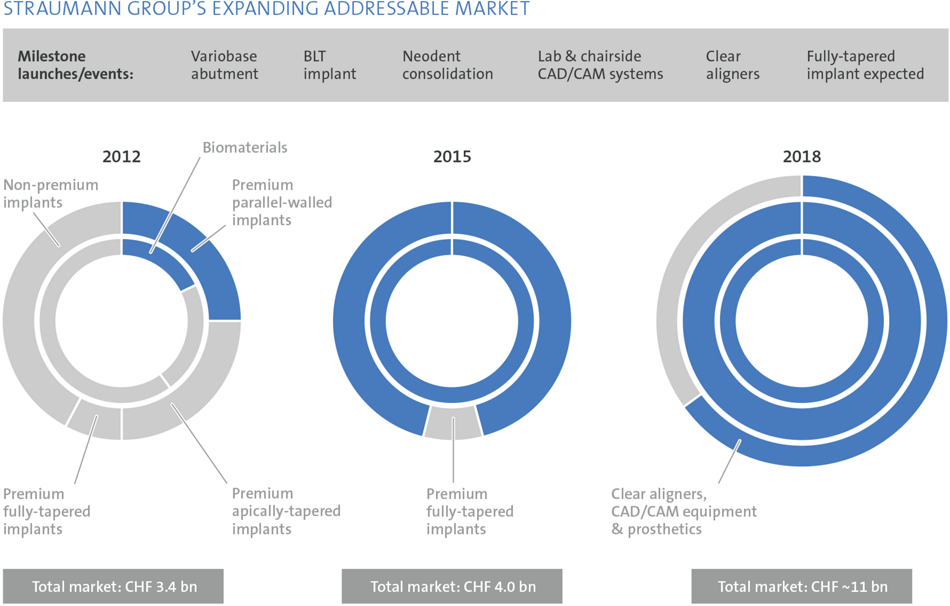

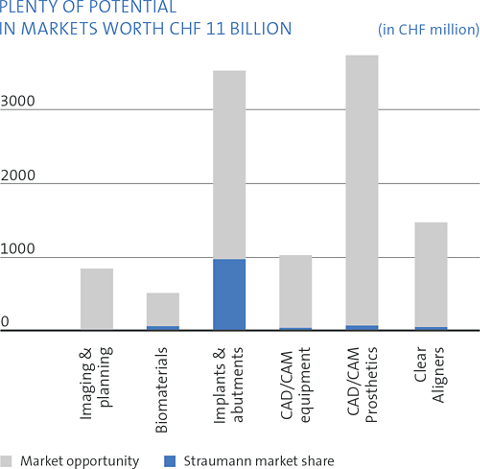

ADDRESSING MARKETS COLLECTIVELY WORTH CHF 11 BILLION

Having concentrated on parallel-walled implants for many years, we have significantly broadened our scope through internal development, acquisitions, investments and partnerships, with the goal of offering complete solutions in both replacement and esthetic dentistry. As a result, our addressable market has expanded significantly, tripling in the past three years alone to approximately CHF 11 billion.

In 2012, we focused on a market worth CHF 3.4 billion, of which we were able to address segments worth a total of just CHF 1 billion because our portfolio was limited to premium parallel-walled implants, standard CADCAM prosthetics and a limited range of biomaterials.

With the consolidation of Neodent in 2015 we stepped fully into the nonpremium segment and our partnership with botiss and other partners gave us a complete portfolio of biomaterials. Straumann BLT and Neodent implants provided access to the large tapered-implant segment, while Variobase enabled us to compete in the fast growing ti-base prosthetic market. By 2015, we had expanded our addressable market to CHF 4.0 billion and were addressing segments worth CHF 3.6 billion.

In the meantime, a series of partnerships and the addition of Dental Wings have provided us with a comprehensive digital equipment portfolio (scanners, mills, consumables and 3D printers) enabling us to offer full in-house solutions to labs and dental practices, in addition to our central milling service. These additions and our entry into the clear aligner business in summer 2017 have further increased our addressable market to CHF 11 billion, which we will be able to address almost fully when we add a fully tapered implant.

FOOTNOTES/REFERENCES

1 MarketsandMarkets 2014, Renub Research 2016 and Straumann estimates.

2 Decision Resources Group 2016-18, MarketsandMarkets 2013 and Straumann bottom-up estimates in 70 countries.

3 Population Reference Bureau (www.prb.org).

4 American College of Prosthodontists, 2016; www.gotoapro.org/facts-figures.

5 Exevia, 2014, based on market research data in Germany, Italy, Spain and the US.

6 Straumann proprietary survey.

7 2016 The Key Group Inc. and Straumann estimates.

8 Decision Resources Group Dental CADCAM Systems 2016, Frost & Sullivan 2017.

9 2016 The Key Group Inc.

10 Epidemiology of Malocclusion and Assessment of Orthodontic Treatment Need for Nepalese Children, V. Singh and A. Sharma, Int. Scholarly.

11 Global Industry Analyst Inc 2016; company reports; internal estimates.