Performance highlights 2019

| Group key figures | |||

| ( in CHF million ) | 2019 | 2018 | Change (%) |

| Revenue | 1596 | 1364 | 17 |

| Gross profit | 1200 | 1019 | 18 |

Core1 |

1207 | 1028 | 17 |

| EBITDA | 481 | 395 | 22 |

Core1 |

505 | 404 | 25 |

| Operating profit (EBIT) | 387 | 343 | 13 |

Core1 |

432 | 348 | 24 |

| Net profit | 308 | 278 | 11 |

Core1 |

338 | 293 | 15 |

| Cash generated from operating activities | 378 | 277 | 36 |

| Capital expenditure | 150 | 110 | 36 |

| Free cash flow | 230 | 169 | 36 |

| Basic EPS (in CHF) | 19.33 | 17.24 | 12 |

Core1 |

21.21 | 18.16 | 17 |

| Employees (at year end) | 7590 | 5954 | 28 |

Notes

1 In accordance with the new directive of the Swiss Stock Exchange, the Group has started to implement the reporting of alternative performance measures (APM), which facilitates the assessment of the underlying business performance but may differ from IFRS reported figures. The ‘core’ figures used in this document exclude one-time M&A effects, exceptional pension-plan items, restructuring expenses, amortization and impairment of goodwill and acquisition-related intangible assets. ‘Before-exceptional results’, which were used historically, excluded the same non-recurring items but not acquisition-related asset amortizations. A reconciliation table of the reported and core income statement with additional descriptions is provided on p. 137 f. of the Financial Report. The figures for 2018 in the table above have been adjusted accordingly.

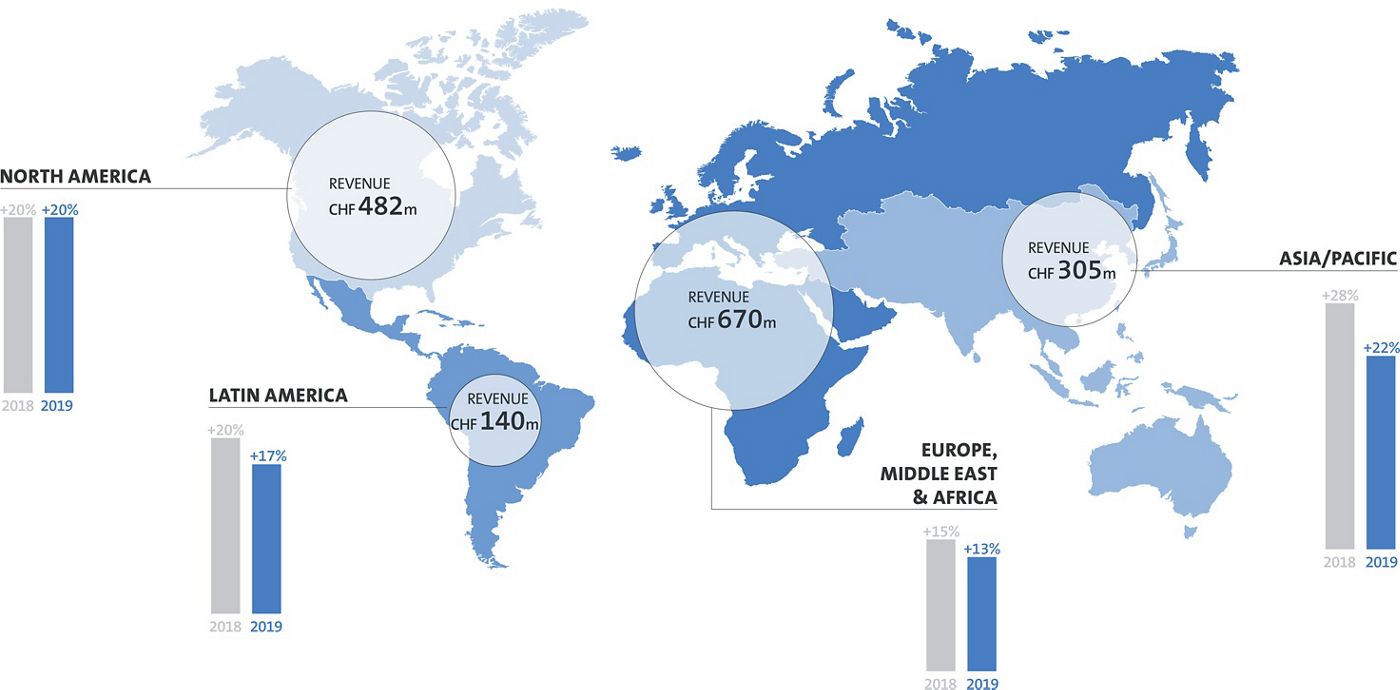

Organic growth by region

All our regions achieved double-digit organic revenue growth, fuelled by emerging markets like Brazil, China, Russia, and Turkey. The largest regional contribution to growth came from our biggest region, EMEA, which grew 13%. Asia/Pacific (+22%) continued to grow the fastest, while North America (+20%) almost achieved its highest growth rate in 15 years, and Latin America (+17%) performed exceptionally in an unstable environment.

Letter to shareholders

Dear Shareholder,

In 2019, the Straumann Group achieved double-digit growth for a fifth consecutive year, lifting revenue by 17% to CHF 1.6 billion. Excluding external growth and currencies, the organic increase also amounted to 17%, clearly exceeding our initial target of revenue growth in the low teens. Fuelled by strong top-line growth, gross profit rose to CHF 1.2 billion (75.6% margin core), enabling us to invest further in innovation, research and development with the goal of providing faster, better treatments with additional predictability, comfort and convenience. We also continued to invest in people (p. 66 ff.) and production (p. 74 ff.).

Despite these developments and the increased share of lower-margin products in our portfolio, we achieved our objectives for improved profitability, as core EBITDA, EBIT and net profit margins reached 31.6%, 27.1% and 21.2%, respectively (29.6%, 26.9% and 21.5% in 2018; see note on page 3 for definition of core).

To expand our value business and to secure key technologies and services, we acquired / incorporated several companies around the world (see p. 40). Collectively, these investments amounted to approximately CHF 102 million. We also invested heavily to expand manufacturing capacity, which together with investments in information technology and other fixed assets, resulted in capital expenditures of CHF 150 million – our highest level to date. Notwithstanding, cash from operating activities surged to CHF 378 million (CHF 277 million in 2018) and free cash flow rose to CHF 230 million (CHF 169 million in 2018).

Management commentary

In 2019, the Straumann Group posted another strong all-round performance, as revenue grew 17% both organically and in Swiss-franc terms to CHF 1.6 billion, fuelled by double-digit increases across all businesses and regions, in spite of the challenging baseline and difficult environment in Latin America. Along with this impressive growth, we achieved further improvements in profitability, despite significant investments in people, culture, innovative technologies, marketing, sales, regulatory support and infrastructure.

| The Management commentary includes the following chapters |

|---|

| Straumann Group in brief |

| Strategy in action |

| Products, solutions & services |

| Innovation |

| Markets |

| Business performance (Group) |

| Business performance (regions) |

| Business performance (financials) |

| Share performance |

| Risk management |

Sustainability report

In our latest strategic materiality assessment, we identified the most relevant topics for business success as well as stakeholder interests. By addressing these material topics, we ensure long-term performance, monitor high-level risks and opportunities, and strengthen relationships with our stakeholders. The materiality assessment is based on interviews with senior managers across the company every year. The interviews are aligned with the principles of the Global Reporting Initiative.

| The Sustainability report includes the following chapters |

|---|

| Sustainability approach and materiality |

| Customers |

| Employees |

| Communities |

| Global Production & Logistics |

| Environment |

Corporate governance

The principles, structures, mechanisms and controls by which the Straumann Group is directed and the people who are responsible for their execution.

Compensation Report

This report provides a comprehensive overview of the Straumann Group’s compensation principles, practices and delivery framework. It also provides information on the compensation of the general staff, management, Executive Management Board (EMB) and Board of Directors. In 2019, we met the majority of our short-term incentive targets across countries and businesses, resulting in a bonus payout at or above target for the majority of our eligible employees. We also exceeded our 3-year objective for total shareholder return, which determines the long-term incentive for Senior Management.

Financial Report

The consolidated financial statements of the Group have been prepared in accordance with International Financial Reporting Standards. In the auditors’ opinion, the statements give a true and fair view of the consolidated financial position of the Group as at 31 December 2019.